Stablecoin Bill Passed: Why Is FRAX Poised to Be the Biggest Winner?

stablecoin bill and FXS

On May 20, the U.S. stablecoin legislation bill, the “GENIUS Act,” passed in the Senate vote, leaving two major steps to formal passage: the House vote and submission for presidential signature. The market previously believed that the Senate vote was the biggest hurdle to the bill’s passage, and barring any unexpected events, its complete passage is just a matter of time.

Which crypto project is the biggest winner of this legislative victory? Judging by the token price performance, it might be Frax Finance.

With the passage of the bill in the Senate, the Frax Finance token FXS (now renamed FRAX, not yet updated on centralized exchanges) once surged above 4.4 USDT, ranking first in the rise list among mainstream exchanges. Even though the price has slightly retraced at present, looking at a longer time frame, FXS’s increase in the month still exceeds 100%.

Why is this bill favorable for Frax Finance, and why is Frax seen by some as the biggest winner of the GENIUS bill?

Frax Finance

Frax Finance’s products are not just stablecoins; they also include liquidity staking, lending, L2, and more. However, they have a deep connection with stablecoins. Frax was once the issuer of the hybrid algorithmic stablecoin FRAX, but after the collapse of Luna UST, it abandoned the “algorithmic stability” track and transitioned to a fully collateralized stablecoin.

After that, FRAX was further updated to frxUSD, using fiat currency as collateral, “the entire roadmap is to become the first licensed fiat stablecoin.”

Frax founder Sam hinted that Frax stands to benefit the most from this bill.

But how does frxUSD qualify to become the “first” licensed fiat currency stablecoin ahead of products like USDC and USDY? From a regulatory perspective, it indeed has the possibility of “having the advantage of being close to the source.”

Sam Kazemian, the founder of Frax Finance, has frequently shared photos of himself with crypto legislative figures in Washington, D.C. since the beginning of this year. It is rumored that he has been deeply involved in the discussion and drafting of the “GENIUS Act” as an industry insider. The market seems to be pricing in the regulatory advantages that Frax Finance is expected to gain from this.

Sam took a photo with crypto-friendly Senator Lummis.

If the speculation is true, as the drafter and participant of the bill, Sam naturally has a deeper understanding of the “GENIUS Act” and it is easier for his project to meet the requirements. Moreover, whether a friendly relationship with legislators will open a regulatory green light for the future of FRAX remains to be seen.

The future roadmap of FRAX

In addition to the potential regulatory advantages, FRAX is building a vertically integrated stablecoin ecosystem, including frxUSD (stablecoin), FraxNet (bank interface), and Fraxtal (L2 execution layer), to adapt to the demands of future regulatory environments:

- frxUSD: As a stablecoin of FRAX, it is pegged to the US dollar at a 1:1 ratio.

- FraxNet: A banking interface designed to connect traditional financial systems with DeFi.

- Fraxtal: an L2 execution layer (or gradually transitioning to L1) that provides efficient transactions and scalability.

Token restructuring is also part of FRAX’s future plans. FXS has been renamed to FRAX, and it has been endowed with functions such as Gas, governance, burning, and staking. This adjustment aims to enhance the functionality and market competitiveness of FRAX, making its operations more flexible in a compliant environment.

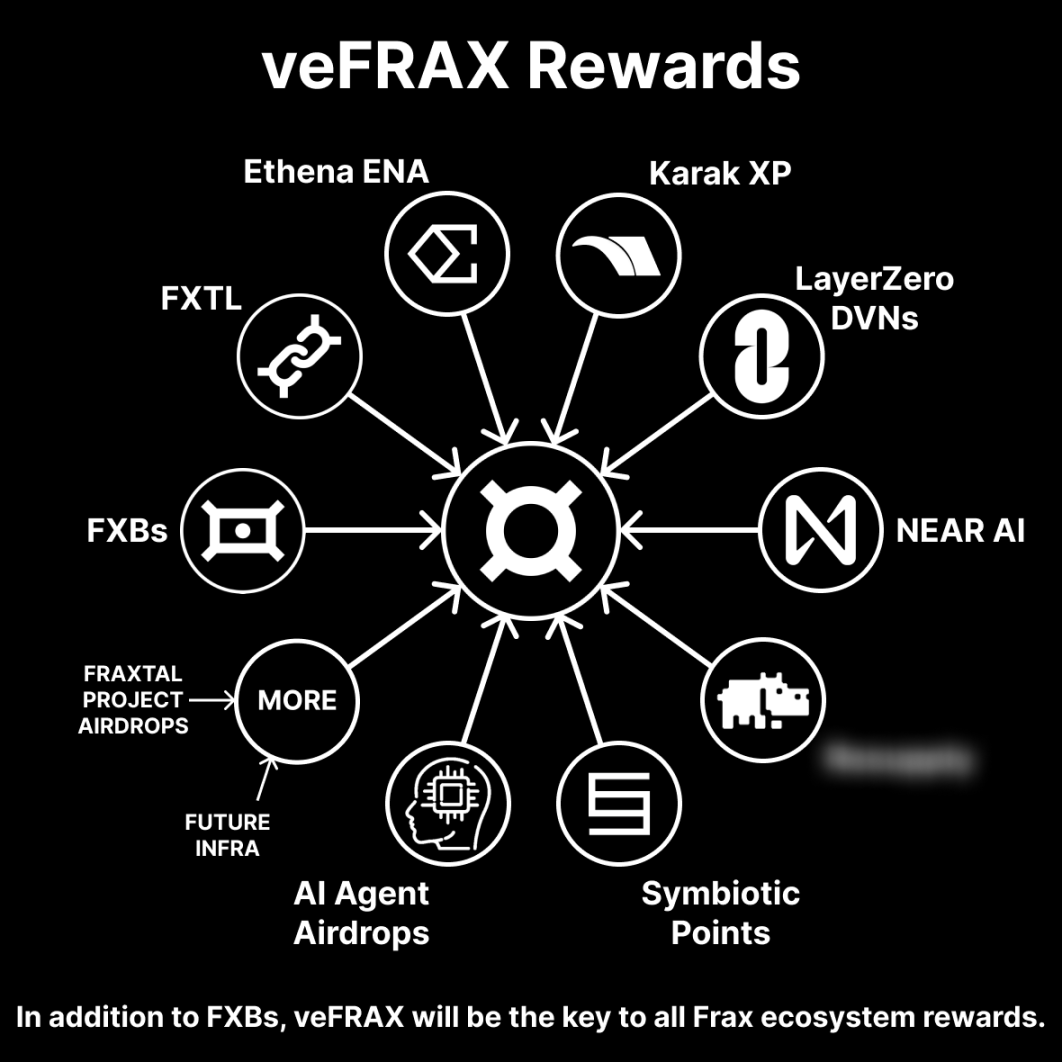

Staking FRAX for veFRAX can earn potential rewards such as FXTL (Frax’s own points), Karak, Ethena, and Symbiotic points.

The founders are actively involved in the legislation related to stablecoins, and the product roadmap is being actively adjusted to serve the narrative. With the further implementation of the “GENIUS Act”, the performance of FXS (FRAX) is worth looking forward to.

Statement:

- This article is reprinted from [ForesightNews] The copyright belongs to the original author [Alex Liu, Foresight News] If you have any objections to the reprint, please contact Gate Learn TeamThe team will process it as soon as possible according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not constitute any investment advice.

- Other language versions of the article are translated by the Gate Learn team, unless otherwise mentioned.GateUnder such circumstances, copying, disseminating or plagiarizing translated articles is not allowed.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

What Is USDT0