Is Capital Driving Compliance? Insights into Polymarket's Global Regulatory Dilemma and Strategies for Survival!

Repost of the original article: “Web3 Compliance Research | Capital-Driven Compliance? Insights into Polymarket’s Global Regulatory Dilemmas and Survival Strategies!”

Traditional U.S. polling organizations never anticipated being replaced not by artificial intelligence, but by a Web3 prediction market. In the 2024 presidential election, polling data overwhelmingly showed Harris maintaining a decisive lead over Trump. Yet on Polymarket, the forecast was vastly different—Trump’s odds of victory were consistently far ahead of Harris. When Trump ultimately swept Harris and won the 2024 presidential race in a landslide, Polymarket’s prediction proved accurate, propelling the platform into the mainstream.

Beneath Polymarket’s meteoric rise, ongoing compliance challenges and regulatory pressure have persisted as the greatest obstacles to its expansion. Facing aggressive regulatory scrutiny worldwide, Polymarket developed its own path to compliance. This article offers a deep dive into Polymarket’s regulatory landscape, compliance risks, and solutions, leveraging an expert lens on Web3 and international regulation. It provides actionable insights for future Web3 founders and teams.

(CNN covers Polymarket’s rise as a prediction market during the U.S. presidential election)

1 What Is Polymarket?

Founded in 2020, Polymarket is a next-generation Web3 prediction market built on blockchain technology, known for its transparency and decentralization. Since launch, it has quickly emerged as a leader in the prediction market sector. Polymarket covers an exceptionally wide array of events—from global politics and financial markets to sports and cultural issues. This broad scope has attracted a large user base, but also introduces significant complexity for regulatory classification across jurisdictions. On Polymarket, users forecast outcomes by purchasing market-specific tokens that represent particular results; these tokens trade between $0 and $1, with the price reflecting real-time collective market sentiment about each event’s likelihood.

Polymarket’s core innovation is turning abstract predictions into digital assets that can be priced, traded, and monetized—enabling users to profit directly from their insights. For instance, during the 2024 election, the “Trump wins” token climbed from $0.30 to $0.92, ultimately settling at $1.00 when the outcome became official. This price trajectory perfectly captured the shift in public opinion. It also generated substantial returns for successful forecasters.

Polymarket’s rapid ascent in Web3 prediction markets has also attracted notable venture investment. It has completed two funding rounds, raising more than $70 million so far, with investors including Ethereum co-founder Vitalik Buterin and Peter Thiel’s Founders Fund.

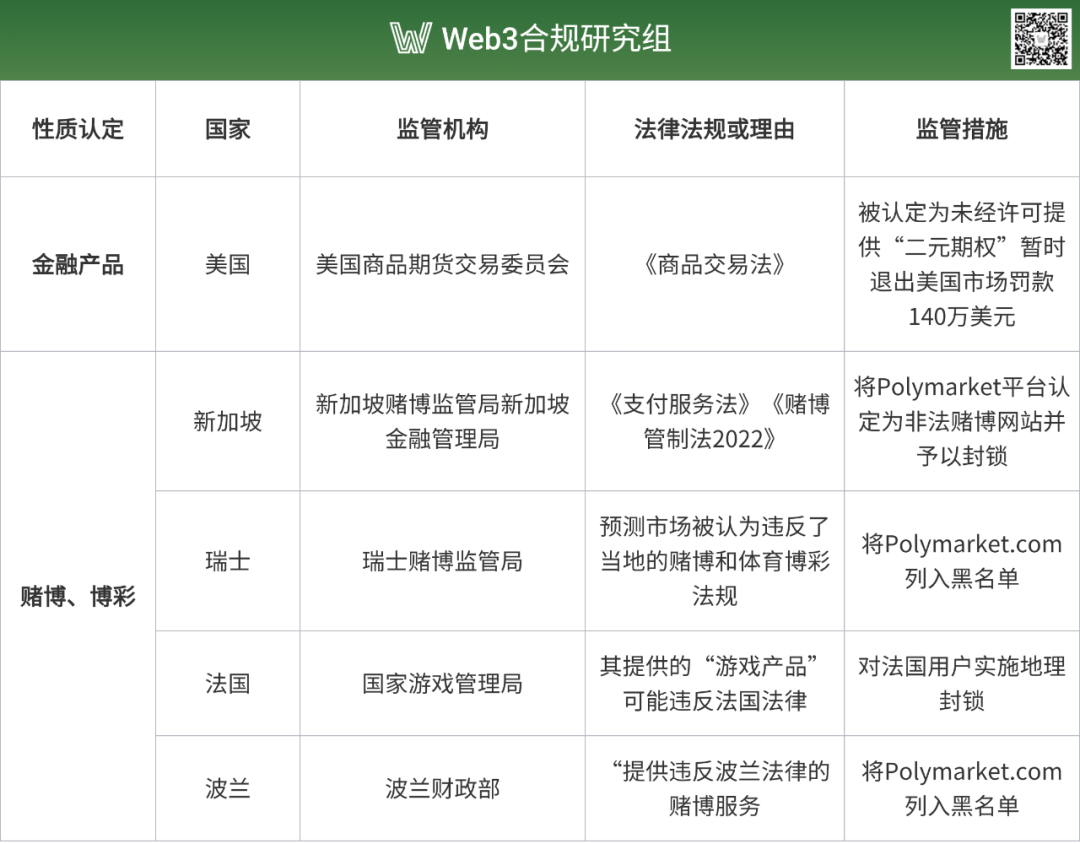

2 Polymarket’s Global Regulatory Challenges: A Snapshot

2.1 United States: Binary Options Classification and CFTC Settlement

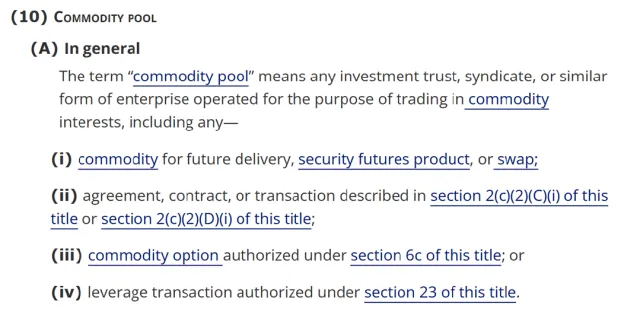

Polymarket’s initial U.S. compliance struggles stemmed from rigorous action by the Commodity Futures Trading Commission (CFTC). In January 2022, the CFTC fined Polymarket $1.4 million and issued a cease and desist order. Under the Commodity Exchange Act, the CFTC determined that Polymarket’s event contracts are subject to its regulations. The Act gives the CFTC authority over futures, options, and swaps markets.

When users can bet on election outcomes, economic metrics, or similar events, the CFTC typically treats such instruments as binary options or swaps, bringing them under its exclusive derivatives jurisdiction. In essence, the CFTC considers Polymarket’s event contracts as financial derivatives—not gambling—and alleged the platform operated an unregistered derivatives exchange, failing to register as a Swap Execution Facility (SEF) or Designated Contract Market (DCM) as required by law.

(Commodity Exchange Act Section 1a(10): Definition of Commodity Pool)

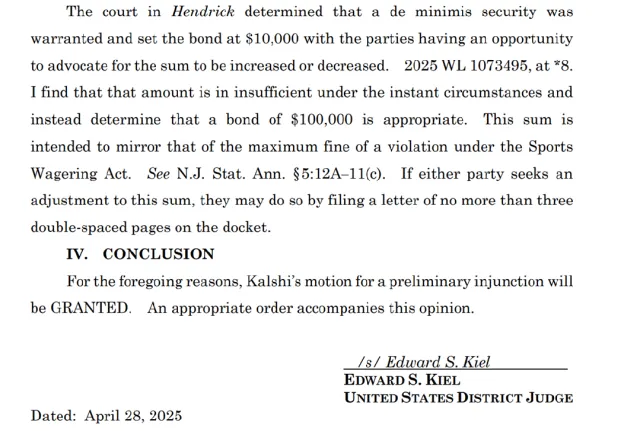

Prediction markets such as Polymarket also contend with regulatory “turf wars” between federal and state agencies. The CFTC asserts exclusive federal authority under the Act, while some state gambling regulators deem prediction markets illegal gambling and pursue litigation. On March 27, 2025, New Jersey’s Division of Gaming Enforcement issued a cease order against Kalshi, Polymarket’s competitor, for offering unlicensed sports betting.

Kalshi responded with protracted legal battles against state regulators. Although District Judge Edward Kiel ruled that Kalshi’s sports events fall under CFTC jurisdiction and ordered New Jersey regulators to halt their interference, this type of federal-state dispute remains unresolved. Such jurisdictional conflict heightens the level of unpredictability for U.S. prediction market regulations.

For platforms like Polymarket, federal approval doesn’t preclude state-level legal risk and lawsuits. This dual-layered regulatory model increases compliance costs and slows nationwide expansion.

(Preliminary injunction granted by Judge Edward Kiel on Kalshi’s request against the gaming enforcement division)

(Original text of the Preliminary Injunction)

2.2 Europe: Gambling Classification and Blacklisting

Polymarket faces tough compliance scrutiny outside the U.S. as well. In the European Union, the Markets in Crypto-Assets (MiCA) regulation established standards for Crypto Asset Service Providers (CASPs)—covering asset-referenced tokens, e-money tokens, and other crypto assets not regulated by previous financial laws. Crucially, MiCA does not specifically address prediction markets, leaving member states free to regulate them as gambling under local law. Despite MiCA’s unified licensing regime for crypto services, prediction platforms still confront fragmented oversight across Europe.

From November 2024 through January 2025, several European regulators took action against Polymarket. Switzerland’s gambling authority added Polymarket.com to its blacklist on November 26, 2024, for violating local betting laws. On November 29, 2024, France’s National Gaming Authority announced that Polymarket had agreed to geo-blocking French users after its “gaming products” raised compliance concerns. Reportedly, high-profile U.S. election bets by a French trader triggered further regulatory attention. Soon after, on January 8, 2025, Poland’s Ministry of Finance blocked Polymarket for operating illegal gambling services.

In summary, European regulators generally take a highly cautious view of prediction markets, treat them as gambling, and impose strict restrictions under local laws.

2.3 Singapore: Dual Statutory Violations

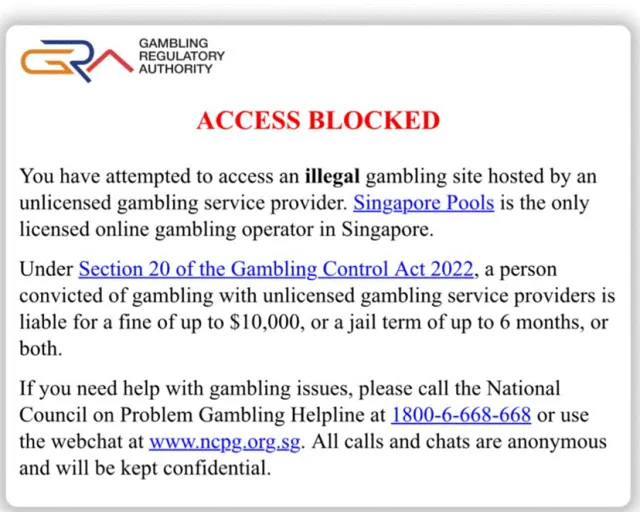

Singapore’s approach combines the Payment Services Act and Gambling Control Act 2022, addressing Polymarket from both financial and social risk angles. The Monetary Authority of Singapore strictly regulates digital payment token service providers under the Payment Services Act, finding Polymarket unlicensed, with elevated AML/CFT risks and insufficient investor protection or dispute resolution mechanisms.

Separately, the Gambling Regulatory Authority classified Polymarket as an illegal gambling website under the Gambling Control Act 2022 and blocked its access. Only government-licensed platforms (such as Singapore Pools) are permitted to provide online gambling services under this law. Thus, Polymarket faces dual hurdles in Singapore—needing licenses for digital payment token services and avoiding strict gambling prohibitions.

(Official notice issued by Singapore’s Gambling Regulatory Authority following Polymarket’s block)

This global comparison highlights a pronounced split in how prediction markets are regulated—between financial and gambling frameworks. The U.S. CFTC tends to treat prediction markets as event contracts under the Commodity Exchange Act, recognizing their value for information discovery and hedging risk. However, this means strict compliance requirements: CFTC registration, KYC/AML procedures, and mandatory reporting.

By contrast, countries like Switzerland, France, Poland, and Singapore categorize platforms like Polymarket as illegal gambling and block access, focusing on curbing speculation, mitigating social harm, and managing moral risk. Such platforms fall under stringent gambling and consumer protection regimes.

Polymarket’s biggest challenge is the absence of globally harmonized regulatory standards, requiring customized compliance plans for each jurisdiction—dramatically raising complexity and cost. These differences reflect the delicate balance regulators must strike among financial innovation, consumer protection, and public ethics.

3 Navigating the Margins: Polymarket’s Compliance Strategies

3.1 United States: Proactive Compliance and Strategic Acquisition

Polymarket responded to CFTC enforcement with transparency, active communication, and genuine cooperation, ultimately securing a relatively modest fine. In January 2022, the company reached a settlement, acknowledged certain transactions as binary options regulated by the CFTC, and agreed to pay a $1.4 million penalty.

The settlement required Polymarket to halt U.S. customer access and impose IP geo-blocking starting in 2022. Its core prediction operations shifted offshore, mitigating domestic regulatory risk. Despite these measures, some American users reportedly circumvented restrictions using VPNs—a reflection of both geo-blocking limitations and strong market demand.

To further adapt and prepare for reentry into the American market, Polymarket appointed former CFTC Commissioner J. Christopher Giancarlo as chairman of its advisory board in May 2022, intending to draw on his expertise in CFTC regulation and market infrastructure. Hiring veteran regulators is a common compliance strategy for American financial and healthcare firms.

In November 2024, Polymarket’s compliance challenges resurfaced when the FBI raided CEO Shayne Coplan’s New York apartment, seizing electronics while not making an arrest. The investigation focused on whether Polymarket had breached its CFTC settlement by failing to prevent U.S. users from transacting via VPN.

With the advent of the Trump administration and more crypto-friendly policies, Polymarket’s regulatory prospects in the U.S. shifted dramatically. On July 15, 2025, the Department of Justice (DOJ) and CFTC officially closed their investigations with no additional charges—resolving years of legal ambiguity and risk.

Soon after, Polymarket acquired QCEX—a CFTC-approved derivatives exchange and clearinghouse—for $112 million on July 21, 2025. CEO Shayne Coplan called this a pivotal move for Polymarket, providing a fully regulated operating framework. Notably, QCEX received its Designated Contract Market (DCM) license on July 9, 2025; Polymarket completed its acquisition just twelve days later. With QCEX’s license, Polymarket can lawfully serve U.S. users. This temporarily puts compliance worries to rest.

Although the acquisition appears to solve U.S. regulatory hurdles on the surface, Polymarket has also made substantial operational concessions. Most notably, the company’s shift in KYC/AML philosophy signals a pivotal transformation. Originally, Polymarket’s appeal stemmed from its “anonymous” and “decentralized” model, eschewing KYC—and quickly scaling as a result. Yet this approach invited regulatory risk and potential market manipulation. Upon acquiring QCEX, Polymarket will likely adopt its stringent KYC/AML protocols mandated by the CFTC.

These compliance requirements include customer identification procedures (CIP), customer due diligence (CDD), enhanced due diligence (EDD), ongoing transaction surveillance, and suspicious activity reporting. The move marks a decisive shift from the early decentralized market conditions of Web3 to a regulated financial services paradigm, with the company continually balancing decentralization with compliance.

3.2 Outside the U.S.: Conservative Approach and Market Exits

Compared to its American strategy, Polymarket has adopted a conservative approach elsewhere. Facing the gambling classification and outright bans in Europe and Singapore, the company has voluntarily implemented geo-blocking for users in France, Singapore, and other regions, effectively withdrawing from these markets without contest.

4 Practical Lessons for Web3 Entrepreneurs

A detailed analysis of Polymarket’s compliance journey provides several critical takeaways for other Web3 founders and teams:

- The Web3 sector is moving on from a “wild west” phase; more projects are going mainstream. To scale and succeed, compliance is now a must.

- Achieving compliance in Web3 doesn’t depend solely on company policy—it’s inextricably tied to government attitudes and regulatory intensity. Polymarket’s U.S. comeback was shaped by political change and policy shifts.

- The Polymarket case exemplifies a capital-driven compliance model: prioritize growth, build scale, raise capital, and then use financial leverage (e.g. acquisitions) to retrofit compliance and legalize operations. This is not just a compliance strategy—it’s a commercial one.

- The global regulatory arbitrage window for Web3 is closing rapidly, driving up compliance costs industry-wide. With the crypto sector maturing, regulators are collaborating and closing loopholes; regulatory arbitrage and offshore strategies are increasingly unviable. The scale-first, comply-later model may not succeed under tighter regulation. Web3 founders must grasp the growing importance of compliance—future competition will hinge not only on tech and product, but also on regulatory and capital strength.

Disclaimer:

- This article was republished from [Web3 Compliance Research Group] under the original title “Web3 Compliance Research | Capital-Driven Compliance? Insights into Polymarket’s Global Regulatory Dilemmas and Survival Strategies!” All rights reserved by the original author [Guiruo Fei Lucius]. If you have concerns about reproduction, please contact the Gate Learn Team, and we’ll act according to policy.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Translations of this article in other languages are provided by the Gate Learn Team. Unless directly referencing Gate, reproduction, distribution, or plagiarism of translated versions is strictly prohibited.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge