From Front-Runner to Follower: Why SOL Struggles Against ETH’s Offensive

On August 13, ETH surged past $4,700, hitting a four-year high, while SOL struggled during the same period, hovering around $200. In 2024, Pump.fun sparked a meme coin frenzy across the entire Solana ecosystem. Early in the year, Trump even launched $TRUMP on Solana, driving SOL’s price close to $300 and fueling a flurry of speculation about whether “Solana would overtake ETH.”

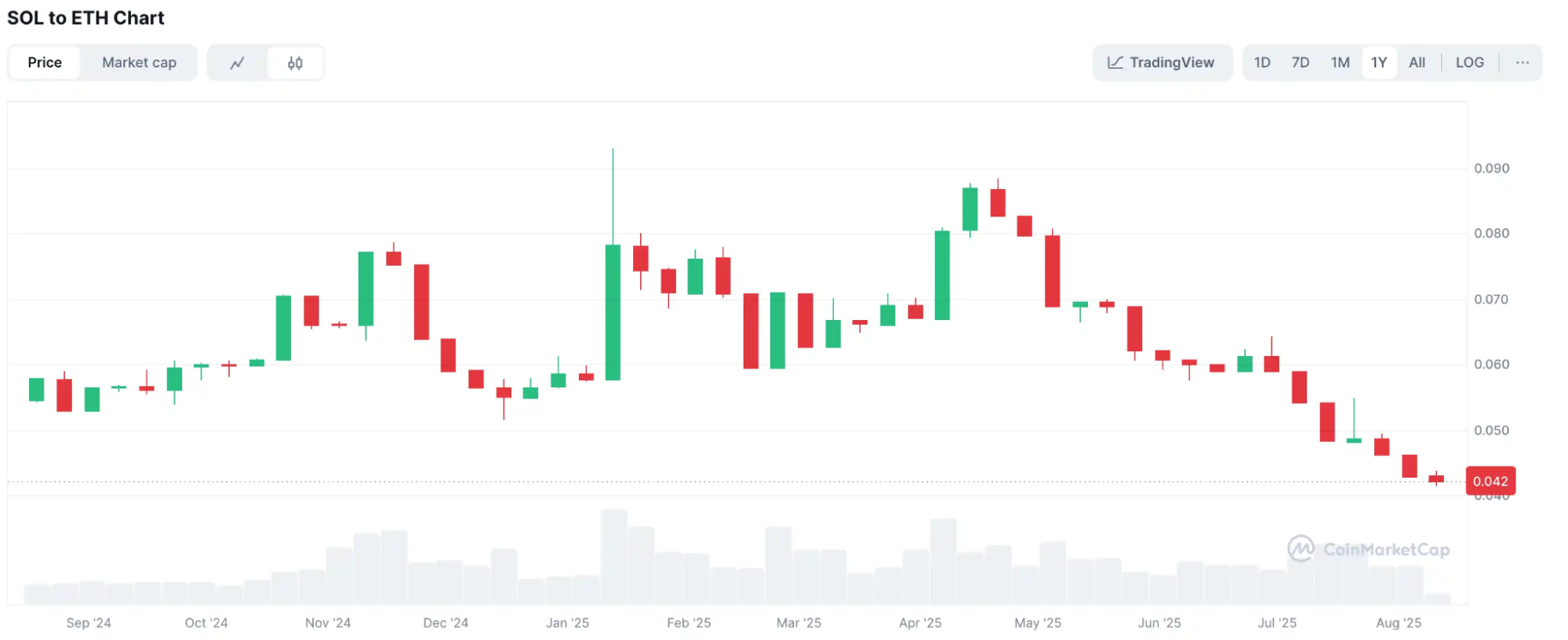

But the actual market performance delivered a sobering dose of reality. Although ETH and SOL both advanced treasury strategies in an effort to build “war chests” for their ecosystems, their results diverged significantly. The SOL/ETH exchange rate dropped from 0.09 at the start of the year to 0.042, and this weakness persisted throughout the year. The underlying causes aren’t just price volatility, but also a reflection of differences in narrative momentum, ecosystem structure, and capital expectations.

Treasury Strategies: Leadership and Capital Scale Divide

On June 30, Wall Street’s famed “contrarian bull” Tom Lee was appointed Chairman of BitMine, when ETH was still sitting around $2,500. Just a month and a half later, ETH rocketed to $4,700—a staggering 88% surge. Lee, a regular on CNBC, Bloomberg, and other top financial outlets, had already made his mark back in 2022 by flipping market sentiment with his accurate “buy the dip” calls during the U.S. stock crash. Now, this market influencer is the perfect spokesperson for ETH’s treasury. At the same time, Cathie Wood’s ARK Invest invested $182 million to acquire BMNR shares, giving ETH bulls even greater confidence.

While both ETH and SOL have treasury strategy firms backing their respective ecosystems, the size gap is remarkable. Treasury companies focused on BTC and ETH dominate the top 10 by holdings. The leading “ETH MicroStrategy,” BitMine Immersion (BMNR), recently raised its financing target to $20 billion to increase its ETH positions, and now holds $5.3 billion in net asset value (NAV)—second only to MSTR. With this level of capital, BMNR can weather market volatility and shape price trends with greater influence. By contrast, the leading “SOL MicroStrategy” player has an NAV of just $365 million, ranking 11th—over 10 times smaller than BMNR. Without a globally recognized public face like Tom Lee, or access to equivalent capital, SOL naturally struggled during this cycle.

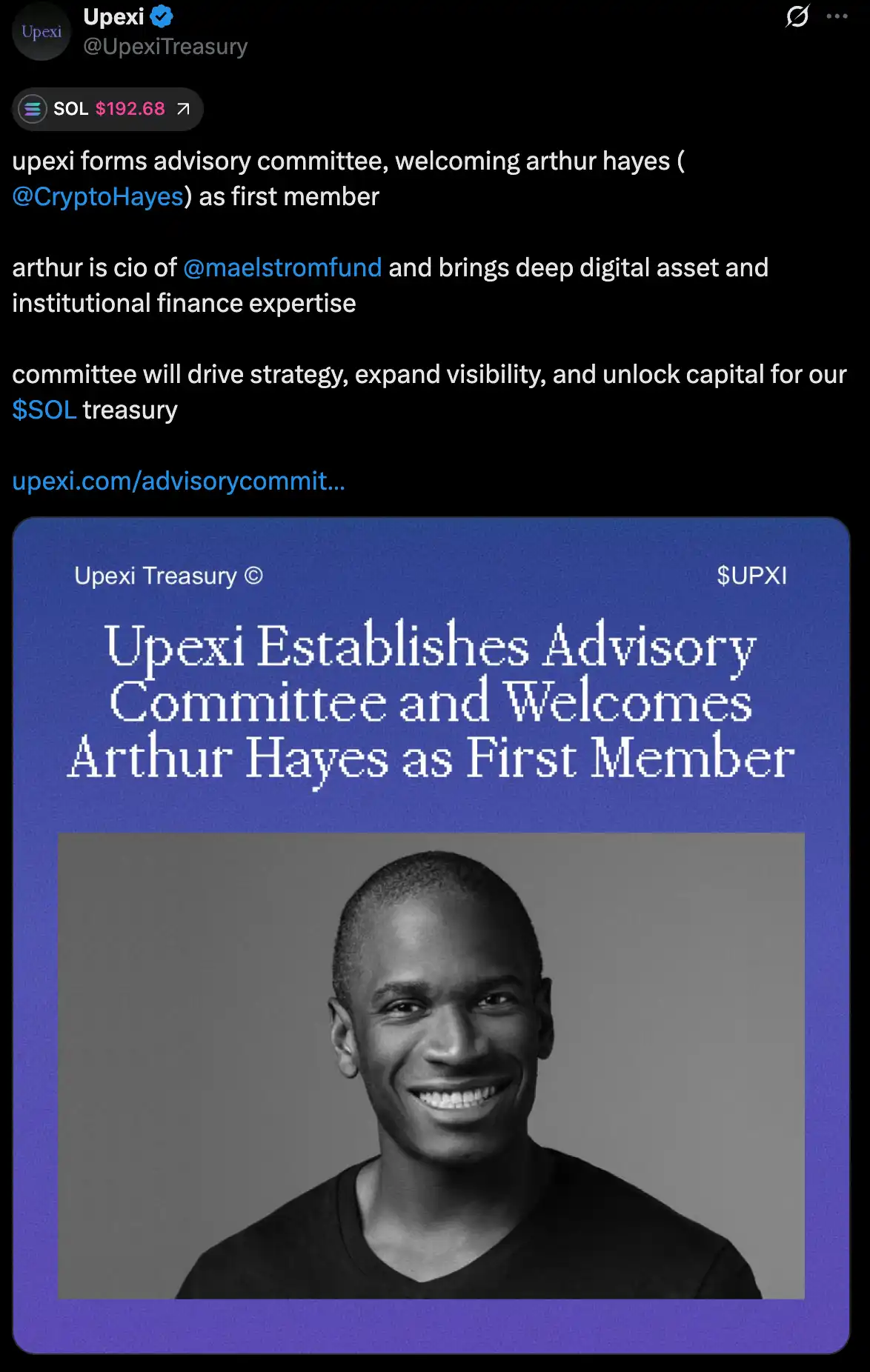

Recently, though, Solana’s side has started to close this gap. On August 12, the leading “SOL MicroStrategy” firm, Upexi, established a new advisory board and appointed Arthur Hayes as its first member. Hayes is co-founder of BitMEX, the creator of perpetual swap contracts, and previously a trader for Deutsche Bank and Citigroup. Now at the helm of digital asset fund Maelstrom, Hayes offers both Wall Street experience and deep insight into crypto market structure—giving Upexi actionable institutional fundraising and crypto strategy guidance.

Upexi’s strategy is clear: use Solana’s scalability and efficiency to expand its SOL exposure. Public filings show Upexi currently holds over 1.8 million SOL (valued at about $365 million) and stakes a portion for 7%–9% yields. This approach ensures long-term holdings and generates steady cash flow. Upexi also acquires locked SOL at a discount to unlock additional shareholder returns. Looking ahead, the company plans to add more crypto and financial professionals to its advisory board.

Other listed companies are boosting their SOL holdings as well. For example, DFDV has grown its position to over 1 million SOL, and BTCM recently disclosed a purchase of approximately 27,190 SOL, with plans to convert more digital assets into Solana. This kind of institutional demand may reduce tradable supply in secondary markets and help support SOL prices.

ETH ETF Leads the Pack, SOL ETF Waits for Breakout

ETH spot ETFs have surpassed $22 billion in assets under management, proving high institutional recognition and securing ETH’s edge in liquidity and market depth. With institutional inflows continuing, BlackRock filed last month to add staking features to its ETH ETF. If approved, this would provide consistent staking rewards for holders and attract more long-term capital.

By comparison, even though REX-Osprey introduced its Solana ETF (SSK) with a staking mechanism in July, it has seen little traction. Most days have zero net inflows, with total capital inflow since launch around just $150 million. Moreover, SSK is not a standard SEC-registered spot ETF, but rather holds SOL indirectly via other structures. This combination of staking and offshore ETF structures complicates understanding and participation, leaving many institutions on the sidelines. REX also lacks the brand recognition and distribution clout of Wall Street heavyweights like BlackRock or Fidelity, and doesn’t have major institutional backers.

Attention is now turning to SOL spot ETF applications from VanEck, Grayscale, and others, expected to hear back as soon as October. Once regulators give the green light—and with treasury allocations ramping up—SOL ETFs could become a growth catalyst for the Solana ecosystem, especially if big institutions seek to diversify beyond BTC and ETH.

Diverging Application Narratives

When it comes to application narratives, ETH and Solana are taking completely different approaches.

Ethereum is methodically building a compliant, sustainable on-chain financial infrastructure. Tom Lee called the exponential rise of stablecoins the crypto sector’s “ChatGPT moment.” Today, the global stablecoin market cap has surpassed $250 billion, with over half of all issuance and about 30% of Gas fees happening on Ethereum. This cements ETH’s core role in payments and settlements, while fueling steady cash flow for staking, DeFi yields, and on-chain infrastructure businesses.

Robinhood is issuing stock tokens on Ethereum Layer2 while Coinbase is doubling down on its Base chain—giving ETH even wider use cases. Ethereum is now virtually the only network able to meet regulatory mandates, ecosystem maturity, and scale all at once. If ETH becomes the backbone for stablecoin payments and RWA settlements, it could gain “structural call option” status among financial institutions, making it a top priority for their portfolios.

Solana, on the other hand, is still dominated by meme coins and hyper-volatile Launchpad projects as its main storyline. Despite multiple attempts this year to enter the RWA segment—launching tokens like $IBRL and supporting the Believe ecosystem with its “Internet Capital Market” slogan—all these efforts fell short. Lately, however, things have started to change. On August 8, CMB International, a subsidiary of China Merchants Bank, partnered with Singapore’s DigiFT and Solana-provider OnChain to tokenize a USD money market fund recognized in both Hong Kong and Singapore, issuing CMBMINT on-chain. This set a new benchmark for cross-border RWA compliance collaboration. On the same day, SOL’s price broke past $200, and the market began treating this as a potential pivot for new narratives—hoping this kind of use case will open broader channels for institutional investment in Solana.

Conclusion

Today, while Solana still trails ETH in market momentum and exchange rates, its fundamental competitiveness and growth potential are far from diminished. As an “American chain,” Solana naturally aligns with U.S. regulatory requirements and capital markets. For now, ETH enjoys the upper hand with treasury strategies, ETF excitement, and dominance in RWA and stablecoin use cases, but that also leaves room for SOL to stage a catch-up rally or pivot the narrative.

Structurally, anticipation of spot ETF approval could unlock fresh institutional capital for SOL. Should VanEck, Grayscale, or other major players get the green light, both liquidity and trading depth could take off. Cross-border RWA pilot projects show that Solana’s high-performance public chain isn’t limited to memes or Launchpads; it has untapped potential in DeFi, payments, and asset tokenization. The current market dip looks more like a buildup for the next stage than the end of the road.

Disclaimer:

- This article is republished from [BlockBeats]. Copyright remains with the original author [kkk]. If you have any concerns about this republication, please contact the Gate Learn team, and we will address your request promptly following standard processes.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions of this article were translated by the Gate Learn team. Do not copy, distribute, or plagiarize translated articles without proper reference to Gate.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge