U.S. Nationwide Stablecoin Regulation: The GENIUS Act and Its Impact

Introduction: The “Year of Legitimization” for Stablecoins

In July 2025, Tim Scott, Chairman of the Senate Finance Committee, officially announced the “Governing the Emergence of Novel Instruments in the United States Act” (GENIUS Act). This bipartisan bill aims to break the three-year regulatory deadlock and provide a clear framework for stablecoin issuance, reserve management, federal and state role division, and cross-border settlement.

This is the first attempt by the United States to address the stablecoin expansion trend through unified federal legislation, and is seen as an institutional compromise between the Federal Reserve, the Treasury, and the crypto industry. As USDT’s market cap exceeds $155 billion and Circle prepares for its IPO on the US stock market, the introduction of the GENIUS Act will not only reshape the US dollar stablecoin market but may also trigger a rebalancing of power between central bank digital currencies (CBDCs) and private stablecoins globally.

This article will analyze in depth the key provisions of the GENIUS Act, the underlying logic of the negotiations, and its potential impact on the stablecoin market structure, international regulatory competition, and policy paths in Hong Kong, China.

Part One: Key Content of the GENIUS Act

Figure: https://www.congress.gov/bill/119th-congress/senate-bill/394/text

1. Background and Timeline of Bill Passage

- June 25, 2025: GENIUS Act first introduced in the House, gaining bipartisan support from key members;

- July 11, 2025: House passes the bill with 289 votes in favor, 131 against;

- July 17, 2025: Senate passes with 67 votes in favor, 33 against;

- July 18, 2025: President signs it into law, officially becoming federal law. The new bill will take effect 18 months after Trump’s signature or 120 days after regulatory agencies issue final implementation rules, whichever comes first.

This marks the first successful completion of a comprehensive legislative process for stablecoins in the US since the introduction of the STABLE Act in 2019.

2. Reserve Requirements: 1:1 Real Asset Backing

The GENIUS Act clearly requires that all stablecoins issued and circulated to the public in the US must be “fully, equivalently, and redeemably” backed by the following assets:

- US dollar cash

- Short-term Treasury bills (no longer than 180 days) backed by Federal Reserve interest rates

- Liquidity instruments recognized by the Federal Deposit Insurance Corporation (FDIC)

This provision directly negates the legality of algorithmic stablecoins (such as DAI, FRAX) or partially over-collateralized stablecoins as “equivalent” reserve basis.

The bill also stipulates that stablecoins must be “redeemable to equivalent US dollar assets within a reasonable time,” establishing the legal status of users’ redemption rights.

3. Registration and Licensing Mechanism: Federal Priority, State Coordination

The GENIUS Act establishes a two-tier registration system:

- Primary Registration: All issuers must register at the federal level, with the option to obtain licenses from the OCC (Office of the Comptroller of the Currency), Federal Reserve, or other authorized agencies;

- Secondary Registration: If a stablecoin issuer wishes to provide services directly to consumers in a particular state, they need to obtain an additional state-level money services license (similar to the current Money Services Business (MSB) licensing model);

This institutional framework will push stablecoins from the “grey area” into the traditional financial licensing system, similar to the review logic for banks or payment institutions.

4. Disclosure and Audit Mechanism: Monthly Reports + Annual Audits

To build public trust and enhance transparency, the GENIUS Act mandates the following disclosure requirements:

- Monthly public disclosure of reserve asset details, including asset classes, holding ratios, and custodial institutions;

- Quarterly audit reports by independent third-party auditing firms;

- Annual financial compliance reviews and risk assessments at the federal level;

- Mandatory disclosure to regulators and activation of emergency mechanisms within 24 hours in case of redemption issues or significant devaluation.

This mechanism is referred to as the “Sarbanes-Oxley for stablecoins,” with transparency and information disclosure intensity approaching that of public company financial reporting requirements.

5. Prohibition of Unsecured or Algorithmic Stablecoin Issuance

The GENIUS Act explicitly prohibits within the United States:

- Issuing stablecoins that rely on algorithmic control without real asset backing;

- Issuing “hybrid” stablecoins that cannot provide daily net asset value redemption or transparent reserve structure disclosure;

- Indirectly issuing unregistered stablecoins for public use through DeFi contracts (indirectly targeting certain on-chain generation mechanisms like Rai or Liquity);

This provision is seen by the industry as a clear ban on “unsecured stablecoins,” and may also mean that decentralized stablecoins like DAI must either completely “USDC-ify” or exit the US market.

Part Two: Impact on Major Stablecoin Issuers

The implementation of the GENIUS Act will undoubtedly redefine the legal standards for “stablecoins” in the US market. Under this institutional framework, issuers face unprecedented pressures and opportunities. Different projects will show divergent trends based on their reserve structures, compliance preparation levels, and development paths.

1. Circle (USDC): The Biggest Beneficiary of the System

Source: https://www.circle.com/

Circle is one of the few stablecoin issuers that has focused on compliance, transparency, and 1:1 fiat currency reserves since its inception. USDC reserves are entirely custodied within the US banking system, primarily consisting of cash and short-term US Treasuries, and have been regularly disclosing reserve structures since 2021, with audits conducted by Grant Thornton LLP.

Key advantages:

- Circle has applied to become a regulated national payment service provider and holds MSB licenses in multiple states;

- Stable partnerships with financial institutions like Coinbase, Visa, and BlackRock;

- Actively seeking authorization under the European MiCA framework, demonstrating strong cross-regional regulatory adaptability.

Expected outcome:

Circle will be able to directly apply for federal licenses and may become one of the first “legal stablecoin issuers” certified under the GENIUS Act, gaining first-mover advantages in areas such as government procurement and CBDC white-label services.

2. Tether (USDT): Transparency Pressure and Institutional Restructuring

Figure: https://tether.to/en/

As the largest stablecoin by market cap globally, USDT has long been criticized for its opaque reserve structure, offshore operations, and insufficient auditing. Although Tether has begun disclosing its asset distribution in recent years and gradually increased its holdings of Treasury bills and cash, some of its reserves still include non-liquid assets (such as precious metals and investment funds).

Key issues:

- Tether’s parent company is registered in the British Virgin Islands, not directly regulated by the US;

- Purely from a compliance perspective, US-based trading platforms or financial service providers will find it difficult to continue supporting USDT;

- The GENIUS Act explicitly prohibits stablecoins that are “not fully backed by real assets,” which will directly limit USDT’s market access eligibility.

Expected outcome: If Tether is unable or unwilling to restructure its corporate architecture, adjust its reserve structure, and complete federal registration, USDT may face the following situations:

- Restricted circulation in US exchanges, wallets, and financial service systems;

- Delisting of USDT trading pairs on some cross-border platforms (such as Coinbase, Kraken);

- Maintaining dominance overseas (such as in Asia, Latin America) but rapidly declining market share in the US.

3. PayPal USD (PYUSD), FDUSD, TrueUSD: Bank Stablecoins Gaining Legal Labels

Figure: https://www.paypal.com/us/digital-wallet/manage-money/crypto/pyusd

These stablecoin projects have typical “bank cooperation” issuance models, for example:

- PYUSD: Issued by Paxos on behalf, integrated with PayPal, with fully disclosed reserve structure;

- FDUSD: Issued by Hong Kong trust institution First Digital Trust, with reserves in US dollars + short-term Treasury bills;

- TrueUSD: Although once affected by custodial disputes, some versions have been adjusted to a model similar to BUSD;

Impact of the GENIUS Act:

- Most of these stablecoins have compliant reserve structures and can quickly adapt to federal licensing requirements;

- Already have cooperative relationships with traditional banks, aligning with the policy thinking of “stablecoins = bank shadow dollars”;

- Once registered, they can rapidly expand application scenarios through Web2 payment networks (such as PayPal, Stripe).

Expected outcome: These stablecoins following the “financial license + on-chain compliance” route will become showcase windows for GENIUS Act implementation in its early stages, gaining priority adoption in government procurement, financial institution pilots, and cross-border payment sandboxes.

4. Algorithmic Stablecoins and Decentralized Models: Complete Underground Transition?

The GENIUS Act explicitly prohibits stablecoins without real asset backing, affecting:

- MakerDAO’s DAI: Although DAI has gradually introduced USDC as partial collateral, its Peg stability mechanism is still not essentially 1:1 redeemable;

- Frax, Liquity, Rai, and other stablecoins using asymmetric collateral or algorithmic control models;

- All on-chain stable assets created through smart contracts or synthetic structures (such as USD+, eUSD).

Challenges faced:

- DeFi projects without fiat currency reserves or bank accounts will find it difficult to obtain federal certification;

- Compliant exchanges and wallets will not be allowed to provide custody or trading support for unregistered stablecoins;

- Algorithmic stablecoin projects will be forced to move into off-chain grey areas or introduce “regulatory partners” to bridge compliance interfaces through DAO restructuring.

Expected outcome: Unless they completely restructure their stability mechanisms and obtain licensed support, algorithmic stablecoins will be systematically phased out within the US. This result is a major blow to the DeFi ecosystem but may also promote the development of “on-chain compliant stablecoin” innovation routes, such as tokenized USDC and on-chain federal reserve representative assets (OFR-Tokens).

Summary:

The GENIUS Act is not merely a regulatory document but a systematic reshuffling. It will reshape the compliance threshold, trust foundation, and industry landscape of the stablecoin track. Circle will secure its position as the compliance champion, Tether faces structural adjustment or strategic contraction, while decentralized stablecoins in the DeFi space need to find new paths on the edge of survival.

Part Three: Far-reaching Impact on the Crypto Market Ecosystem

With the promulgation of the GENIUS Act, the United States is not only attempting to bring stablecoins into the regulatory system but also intends to reshape the security, compliance, and sovereign attributes of the entire crypto financial infrastructure through institutional means. The impact of this legislation on the market ecosystem is systemic, with its reach extending far beyond stablecoins themselves.

1. User Trust and Stablecoin Use Cases Will See an Explosion

For a long time, one of the biggest “selling points” of stablecoins has been their low-cost, borderless, and instantaneous “digital cash” characteristics. However, due to opaque audits, unsound redemption mechanisms, and unclear issuer responsibilities, many users and institutions have consistently viewed stablecoins as “technological convenience” rather than “financial trust.”

The implementation of the GENIUS Act will effectively alleviate this structural trust crisis:

- Clearly defined redemption rights will give stablecoins the substitutability credit of legal tender;

- Disclosure and audit mechanisms will enhance user confidence in reserve safety;

- Compliant stablecoins can be embedded in Web2 applications (e-commerce, payments, travel) and traditional financial institutions (banks, brokers, wealth management platforms);

Expected explosion scenarios include:

- Native integration of compliant stablecoin payments in e-commerce sites and content platforms (e.g., Shopify + USDC);

- Mainstreaming of cross-border freelance and remote labor contract payments;

- Companies and DAOs using stablecoins for payroll and supply chain settlements;

- Large-scale replacement of low-cost remittances (e.g., US-Latin America, Southeast Asia channels) by stablecoins.

2. Acceleration of Institutionalization Trends in Crypto Infrastructure

Following clear regulatory signals, service providers in the on-chain infrastructure layer will also undergo structural transformation:

- Wallet products: MetaMask, Phantom, etc., need to distinguish between compliant and non-compliant stablecoins and preset user identity verification (KYC) modules;

- On-chain payment interfaces: Stripe Crypto, Circle Pay, etc., will receive policy support for embedding traditional financial interfaces;

- DeFi protocols: Need to adapt to compliant asset whitelist mechanisms (e.g., Aave GHO integrating USDC only);

- Audit and custody services: Chainalysis, Fireblocks, etc., will become the “backend operating systems” of compliant on-chain financial systems.

This will usher in a new cycle of “on-chain financial SaaS-ification” - the boundaries between traditional financial service providers and Web3 projects are blurring, evolving into a collaborative structure of “compliant API providers” and “user touchpoint integrators.”

3. Stablecoins Become Extension Carriers of US Digital Hegemony

The GENIUS Act is not isolated from the technical regulatory system but deeply tied to the US financial strategy.

In the traditional international financial system, the US dollar’s dominant position is built on Swift, CHIPS, clearing banks, and the Treasury market. In the on-chain world, the “pegged asset system” dominated by the US dollar - namely stablecoins - is the re-expression of financial hegemony in the digital age.

With the promotion of the GENIUS Act, the US will expand its digital sovereignty through the following paths:

- Requiring global exchanges to “only support compliant stablecoins,” forming regulatory exports;

- Encouraging US companies to use stablecoins for global supply chain settlements, replacing local currencies or bank wire transfers;

- Federal government can directly purchase or hold compliant stablecoins for aid, clearing, and loan project pilots;

- US dollar stablecoins serve as “digital colonial tools,” accelerating penetration into developing countries’ on-chain financial systems;

Stablecoins are not just the result of US dollar digitization but are becoming the strategic frontier of US dollar soft power. The GENIUS Act provides an indispensable legal backing for this.

4. L2 and DeFi Will Benefit from the Injection of High-Quality Liquidity

For a long time, the development of Layer 2 networks and DeFi protocols has been constrained by differences in on-chain liquidity quality:

- Some stablecoin liquidity is limited by centralized issuer or contract authority risks;

- Users lack trust in “protocol-generated stablecoins” and are unwilling to lock up funds on-chain for long periods;

- Institutional capital lacks a “clean path” to enter DeFi compliantly;

After the GENIUS Act, Circle, Paxos, and others will be able to directly deploy stablecoin issuance contracts on Layer 2 networks, ushering in the era of “native L2 compliant stablecoins.” Base, Arbitrum, and OP Stack chains will become hotbeds for compliant stablecoin deployment.

At the same time, DeFi protocols can introduce “whitelist stablecoin pools” and “auditable asset collateral pools” mechanisms to attract traditional funds into trustless lending, trading, and market-making areas.

DeFi’s “grey capital era” will transition to a “white structured capital era.”

5. Black Market Stablecoins and Offshore Operators Will Be Systematically Squeezed

The institutionalization process of compliant stablecoins will inevitably be accompanied by the exclusion of non-compliant assets:

- Exchanges need to delist trading pairs of unlicensed stablecoins (such as Tether, DAI);

- Wallets need to label or default to blocking “uncertified stablecoin contracts”;

- Institutional market makers and funds need to comply with “liquidity asset compliance lists”;

- Black market OTC markets will find it difficult to maintain USDT-based quotation systems;

This will cause a large number of offshore traders, arbitrageurs, miners, and other groups to lose their most convenient US dollar stable bridge, forcing them to seek alternative solutions such as non-US dollar pegged, on-chain native assets (like EUROe, sDAI, wCNY, etc.).

The other side of the rise of compliant stablecoins is the decline of the “on-chain free dollar” ecosystem.

Summary

The GENIUS Act is not just a regulatory framework for stablecoins but a strategic tool for the United States to promote digital financial infrastructure upgrades and strengthen monetary influence. While reshaping market trust, it will also guide the entire Web3 world into a “post-freedom era” - a new phase where compliance comes first and on-chain and off-chain integration.

Part Four: Regulatory Comparison Across Regions

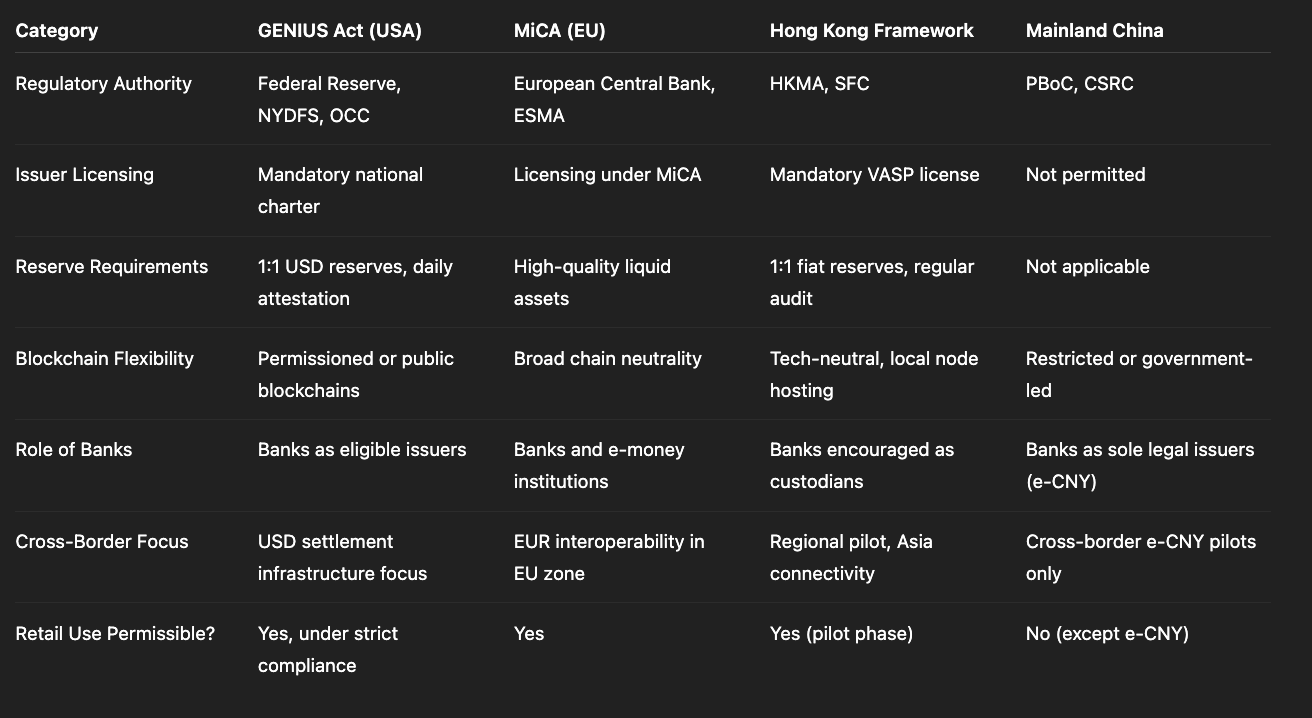

Stablecoin Regulation Comparison: GENIUS Act vs Other Major Policies (Source: Gate Learn creator Max)

The GENIUS Act has a demonstrative effect globally, but its regulatory approach shows significant differences compared to other major economies.

European Union

The MiCA regulation, effective in 2024, distinguishes between “Electronic Money Tokens (EMTs)” and “Asset-Referenced Tokens (ARTs)”, emphasizing consumer protection and cross-border operation licensing.

Core regulation focuses on risk disclosure and market entry thresholds;

Allows a certain percentage of algorithmic or hybrid stablecoins to be piloted in sandboxes;

Applies to all 27 member states, facilitating circulation within a unified financial market.

Comparison: The US focuses on “USD dominance + 1:1 hard backing + federal license”, which is more rigid and suitable for dominating global USD settlements; the EU emphasizes financial diversity and consumer protection.

China

In mainland China, “stablecoins” are not yet officially recognized or widely used. The central bank-led digital yuan (e-CNY) is technically maturing but still has limitations in international settlements and third-party ecosystem integration.

In Hong Kong:

The HKMA issued stablecoin issuance guidelines in 2024, requiring 100% asset reserve backing and licensed institution participation;

Multiple Hong Kong financial institutions are piloting HKD or USD-pegged stablecoins, such as HKD Stablecoin;

Hong Kong has become the Asian business outpost for compliant US issuers like {Circle}, {Paxos}, and {Anchorage}.

The passage of the GENIUS Act will further promote Hong Kong’s role as a “USD on-chain settlement hub” and may indirectly influence the openness and cooperative attitude of mainland regulatory strategies.

Part Five: Potential Risks and Uncertainties

Although the GENIUS Act provides institutional breakthroughs, its implementation still faces several challenges:

- Long legislative passage cycle: The bill has passed, but implementation won’t be possible until Q4 2025 at the earliest;

- Federal and state government coordination issues: Some states may continue to assert local licensing independence, increasing regulatory coordination complexity;

- Innovation suppression: Algorithmic stablecoins and DeFi-native stablecoins may be marginalized;

- Increased technical integration costs: Compliance burdens for small and medium-sized issuers may increase, potentially exacerbating market concentration.

These factors will determine whether the GENIUS Act is “a new starting point for USD stablecoins” or just another regulatory exercise.

Conclusion: The Starting Point of Global Stablecoin Regulatory Competition

The GENIUS Act is the first time the US has seriously addressed the systemic risks of stablecoins and attempted to regulate them through a federal system. It’s not just a technical upgrade in financial regulation but also a deep intervention in the relationship between USD internationalization, crypto financial systems, and central bank digital currencies.

From a macro perspective, it marks the beginning of the “on-chain USD regulatory competition” era, with financial centers like Hong Kong, UAE, and Singapore potentially gaining early advantages due to policy flexibility.

For Web3 companies, financial institutions, and even sovereign powers, understanding, accessing, and participating in this system will directly determine the next phase of the fintech landscape.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

What Is USDT0